The Physician’s Role in Immune Globulin Reimbursement

Attention to meeting payer requirements is good for the bottom line.

- By Bonnie Kirschenbaum, MS, FASHP, FCSHP

There’s no question that healthcare professionals have an overflowing basket of tasks and important issues to tackle, as well as a myriad of infrastructure problems to solve. But, ensuring a healthy revenue stream is a priority, too. And, when it comes to expensive medications such as immune globulin (IG), a healthy revenue stream relies upon clinicians caring about reimbursement. Reimbursement is everyone’s responsibility. Knowing and adapting to the nuances of how to be reimbursed for a product often prevents having to challenge payment denials.

Data drive decisions, and data are submitted to the payer making decisions about reimbursement regardless of whether the payer is Medicare, Medicaid or the private sector. Submitting data can be a challenge for clinicians with the workforce and budget changes that are the result of the myriad of new payment models that healthcare insurance reform has spawned. But, clinicians are expected to be players, not barriers, to implementing these changes. After all, reimbursement is what pays for the care that clinicians’ facilities offer.

Discussed here are some areas that may be overlooked when it comes to reimbursement for IG under Medicare, the model that third-party payers and Medicaid often follow.

A Quick Reimbursement Review

Whether patients are considered inpatients or outpatients has nothing to do with where in a hospital facility patients are located or are being treated, but everything to do with their admission status. Anyone not admitted to the hospital as an inpatient is an outpatient, including observation patients. Inpatients fall under the inpatient prospective payment system (IPPS) based on the Centers for Medicare and Medicaid Services (CMS) Medicare Severity Diagnosis Related Groups (MS-DRG) model, and with few exceptions, it has no provision for separate reimbursement for medications, biologics or immunologic agents. The MS-DRG model is the quintessential model of bundled payment under which facilities are paid a fixed amount based on an aggregate of all detailed information provided to Medicare. However, facilities are still required to line item each bill because that data is in part what determines reimbursement. Failure to provide accurate data is interpreted by Medicare as a product not being used, which subsequently results in artificially low reimbursement to facilities.

Outpatients fall into the outpatient prospective payment system (OPPS), which has provisions for separate reimbursement for some medications, biologics or immunologic agents. It also has a model of bundled or packaged payment for drugs under $90 per day in 2014 (proposed) with fixed amounts paid to facilities that are based on an aggregate of all detailed information provided to Medicare. Again, not providing accurate data results in artificially low reimbursement.

Billing for drugs, biologics and immunologics is based on billing units, with the actual dose administered being converted into the appropriate number of billing units. Several years ago, CMS implemented the concept of billing units rather than vial sizes when structuring reimbursement. Both Medicare and Medicaid use billing unit codes, although not necessarily the same ones, and implementation of this concept continues to plague facilities. Billing unit tables are not static, so vigilance is required to ensure that the correct billing units are matched to the correct Healthcare Common Procedure Coding System (HCPCS) billing codes. Failure to do so results in significant overcharging or undercharging, and the resulting complications, especially for very expensive medications such as IG, are a natural target for audit!

The Role of MACs

CMS has geographically assigned Medicare administrative contractors (MACs) to serve as intermediaries between healthcare facilities and CMS. All financial transactions are submitted by healthcare facilities to MACs to process them for payment. There are subtle differences between how each MAC chooses to operate such as the required documentation and a variety of other issues. Therefore, it’s imperative that facilities know who the MAC is for their region and that they get onto their MAC’s e-distribution mailing list for updates.

When processing claims, MACs determine if all program requirements for coverage are met (e.g., whether the charges are reasonable and necessary to treat the beneficiary’s condition or whether they’re excluded from payment). This is often determined by local coverage determinations (LCDs), but also by national coverage determinations (NCDs), which apply to all geographies. The key is knowing the requirements upfront rather than having to fight them after the fact. It’s a concept similar to prior authorization used by commercial payers.

A dilemma often arises when the literature supports treatment with drugs, biologics and immunologics for a non-U.S. Food and Drug Administration (FDA)-approved indication (known as an off-label indication). The fact that it’s off-label may be sufficient grounds for a MAC to deny payment. This is certainly the case for IG products. Close review of each set of labelled indications reveals numerous differences between products, and they must be taken into consideration before products are ordered. Officially accepted compendia can be used to support an off-label decision, but clinicians should be aware of what they are. Patient and billing assistance programs offered by several of the pharmaceutical companies also may be helpful in providing support in attempting to overturn denials.

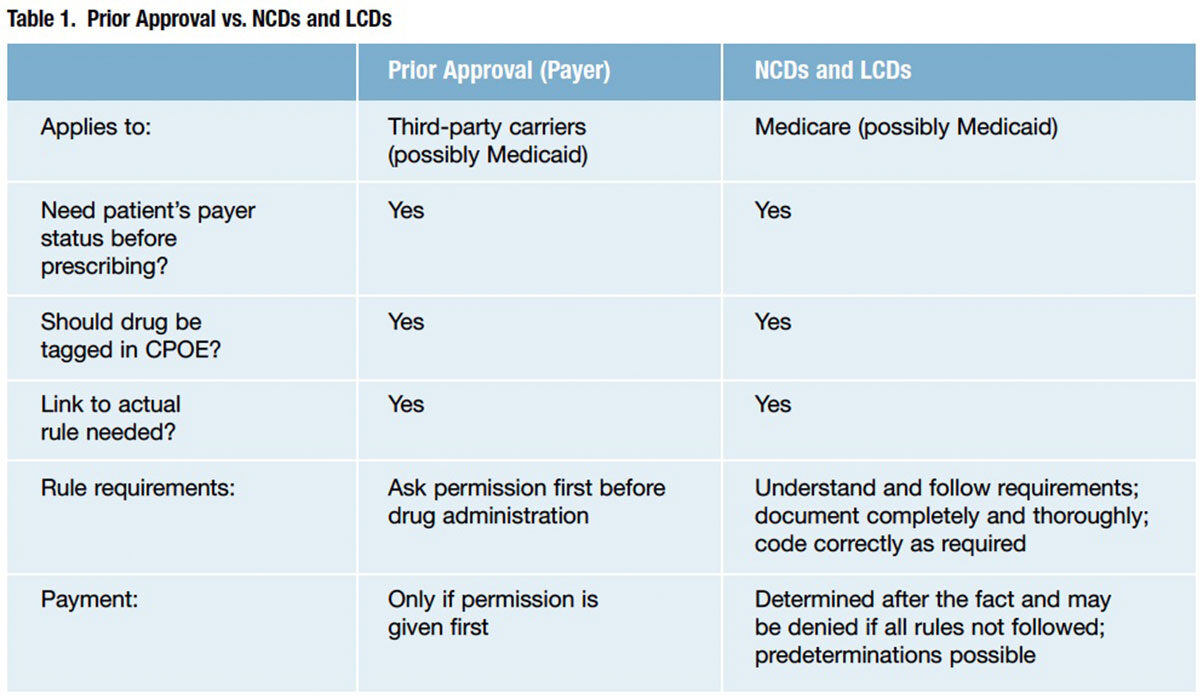

Clinicians often struggle with understanding and accepting that payer pre-approval is required for their clinical decisions, and they often perceive the task of gaining pre-approval as arduous and that it should be left to others. On the other hand, payers view this as documentation of data needed to ensure that the clinical decision is a reasonable and necessary one that contributes to the data pool that drives clinical decision support and evidence-based medicine. Table 1 compares prior authorizations required by third-party payers and CMS for LCDs and NCDs.

Electronic health records and the use of computerized physician order entries (CPOEs) with appropriately built code sets and links can streamline this process. Nevertheless, emphasis must be placed on understanding what’s required before a product is ordered, and then completing and documenting the steps. Appeals of payment denials have little chance of success if this logic isn’t followed. Documentation, tests or other required steps can’t be done after the fact.

Understanding the Codes

Coding is the language that describes what treatment was performed and what drugs, biologics or immunologics were used. It is the operational link between coverage and payment. However, any payer at any time can decide it is not going to pay a claim.

- ICD-9 codes are currently used by hospitals to designate disease types. However, these codes will be replaced by ICD-10 codes in October 2014. Because of the increased complexity and specificity of ICD-10 codes, clinicians need to data mine to determine what they are not currently documenting and receive very focused training.

- Current procedural terminology (CPT) codes are descriptive and identifying terms created by the American Medical Association and its specialty organizations for reporting medical services, procedures and lab tests that provide a uniform language describing medical, surgical and diagnostic services.

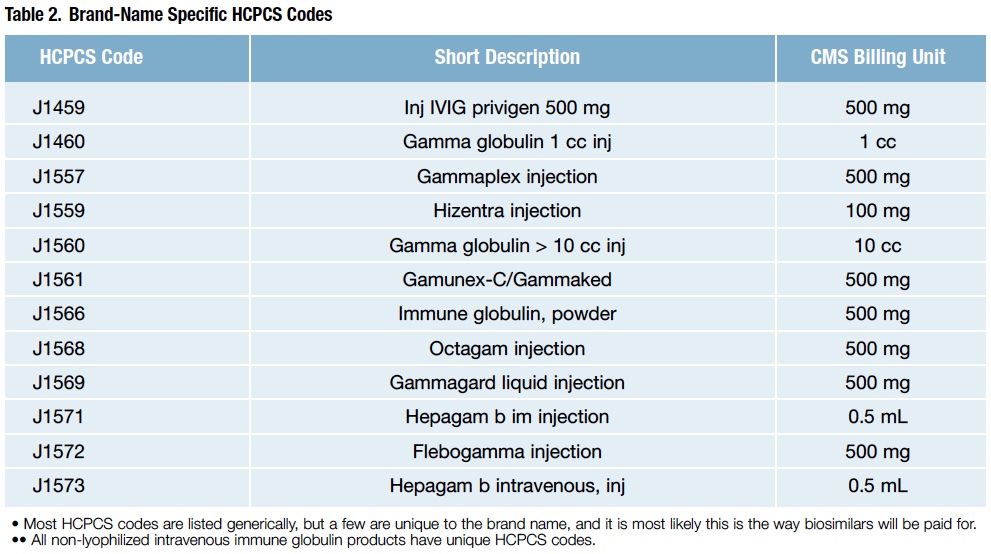

- HCPCS codes describe products. However, the fact that a drug, device, procedure or service has an HCPCS code and a payment rate under OPPS does not imply coverage by Medicare. Instead, it indicates only how the product, procedure or service may be paid if covered. Although most HCPCS codes are listed generically, beware that there are several brand-specific codes, too, and IG products are on that list (Table 2).

Understanding ASP Drug Pricing Files

CMS reimburses based on average sales price (ASP) and publishes a quarterly updated ASP drug pricing file in three formats. This file provides links to the actual listing of reimbursable Medicare Part B drugs and the amounts that will be reimbursed, as well as a reminder of the billing units for each drug code, the NDCs and the total billing units in each vial per NDC. ASP is calculated based on sales data from the manufacturer, not from the distributor. Not surprisingly, reimbursement for some drugs goes up, and for other drugs, it goes down. This can be a result of a number of competitive market factors: multiple manufacturers, alternative therapies, new products, recent generic entrants or market shifts to lower-priced products, as well as the weighting given to the package sizes sold.

Injectable Patient Assistance Drugs vs. White Bagged Drugs

There is little difference between injectable patient assistance drugs and white bagged drugs. In both cases, the drugs are sent to the physician office or pharmacy by a distributor, manufacturer or specialty pharmacy at no cost to the physician or pharmacy.

White bagging is the practice of having patient-specific medications or supplies delivered directly to the practice setting (outpatient infusion center, physician office, hospital) for use by a specific patient. The practice arose due to the requirements of some insurance carriers mandating the use of specialty pharmacy, manufacturer-supported patient assistance programs and/or FDA-assigned risk evaluation and mitigation strategy (REMS) programs.

Because the medications may be prepaid or complimentary, no billing for these products/supplies transpires. However, billing for the clinic visit where the drugs are administered and for the drug administration itself still brings income to facilities. Medicare has specific requirements for how this transpires, so it is essential for facilities to follow the guidelines determined by their MAC. Essentially, the drug is billed at a zero charge to indicate that it was administered, which allows the drug administration fee to be processed.

Getting Ready for 2014

Recently, proposed OPPS rules covering Medicare outpatient reimbursement were published, comments were reviewed, and final rules are to be published in early January. Following are some of the proposed rules affecting IG reimbursement.

New drugs not yet assigned a unique HCPCS code. An injectable drug first coming to market that has been given pass-through status but does not yet have an HCPCS code is paid for at 95 percent of average wholesale price using code C9399, unclassified drugs or biologicals, along with the NDC number of the product being administered. This is proposed to remain for 2014 to cover new entries into the market.

New pass-through drugs with HCPCS codes. If the manufacturer has diligently worked toward it, the new product may have an HCPCS code when FDA gives its approval. If so, it must be used. It is paid at wholesale average cost plus 6 percent until the ASP is available, at which time it is paid at ASP plus 6 percent. Pass-through status is time-limited, usually two to three years. This also is proposed to remain for 2014. The lists of products gaining and losing pass-through status for 2014 (proposed) have been published. Only one IG product is on the list: injection, immune globulin (Bivigam), 500 mg, HCPCS code C9130, status indicator G, APC 9130. And, one product lost this status: injection, immune globulin (Flebogamma/Flebogamma dif), intravenous, non-lyophilized (e.g., liquid), 500 mg, 2014 HCPCS code J1572, status indicator K, APC 0947.

Specified covered outpatient drugs (SCODs) costing more than $90 per day. The majority of drugs are reimbursed in this category, which is where most drugs land once their passthrough status expires and where the cost per day of the product is assessed each year. Proposed for 2014 is that only drugs costing more than $90 per day will be separately reimbursed at a proposed rate of ASP plus 6 percent both in the physician office setting and by OPPS. This is how most IG products are paid for.

Lower-cost packaged products costing less than $90 per day. There is no separate reimbursement for these products. Rather, payment for them is included in the bundled payment for the specific procedure/visit for which they were used. However, if administered as infusions, payment for drug administration is available separately from the bundle.

Getting Reimbursed

To maintain a healthy revenue stream, clinicians must remain attuned to the nuances of reimbursement, as well as anticipate the increasing complexity and specificity the process will require. Increasingly, data analytics is driving decisions, and physicians are the ones contributing the data with every transaction their practice submits.

References

- Federal Register, Vol. 78, No. 139, July 19, 2013, Proposed Rules. Table 19: Proposed Drugs and Biologicals with Expiring Pass-Through Status 12.31.2013 (page 43599) and Table 20: Proposed Drugs & Biologicals with Pass-Through Status in CY 2014 (page 43600). Accessed at www.gpo.gov/fdsys/pkg/FR-2013-07-19/pdf/2013-16555.pdf.