The Plasma Industry: Investing Today to Ensure IG and Albumin Supply for Tomorrow

- By Keith Berman, MPH, MBA

BEHIND ALL THE vials of immune globulin (IG) waiting on the pharmacy shelf are two important behind-the-scenes activities that make it possible: long-term manufacturer commitments to invest in new production capacity, and the willingness of many thousands of new donors to contribute very large quantities of blood plasma, the sole raw material from which this product is purified.

Consider an adult patient about to receive a 30-gram dose of intravenous immune globulin (IVIG) given as IgG replacement therapy. About 3.5 to 4 grams of IgG can be purified from each liter of plasma. Thus, around 10 plasma donations, each averaging about 750 milliliters, go into producing that single dose. Another common dose used for treatment of certain autoimmune disorders — one gram per kilogram body weight —requires collection of roughly 18 to 20 liters from at least 25 “source” plasma donations obtained by carefully supervised plasmapheresis at a licensed plasma collection center.*

Global Demand Grows, Industry Responds

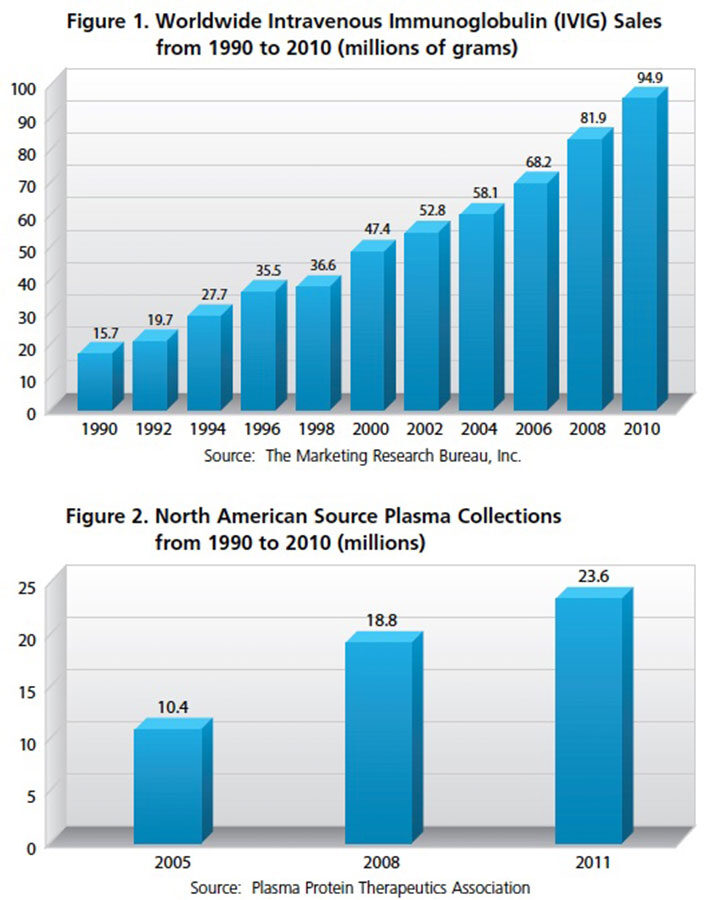

Now consider what those plasma requirements mean in the context of more than two decades of steady, uninterrupted growth in IG demand. From worldwide IVIG product sales of about 16 million grams in 1990, expanding numbers of clinical indications and increasing physician awareness drove sales to about 47 million grams by 2000. And, global demand continued to climb, doubling to 95 million grams by 2010 (see Figure 1). Just over the five-year period from 2006 through 2011, global sales of IVIG and subcutaneous IG (SCIG) products have jumped from 69 million grams to just over 107 million grams —an average of nearly 10 percent annually, according to Patrick Robert of The Marketing Research Bureau (MRB), a Connecticut-based firm that tracks and reports market data for all therapeutic plasma products. Global demand for human albumin solutions used in surgeries, shock and a variety of other settings has increased more than 50 percent over the last decade.

For most sectors of the drug industry, supply readiness to meet this rate of demand growth is straightforward: Contract to purchase more raw materials, increase scheduled production runs or build more manufacturing capacity, and add filling lines and perhaps some warehouse capacity for storage of finished goods. But for manufacturers of human plasma-based therapeutics, that unique raw material creates dynamics that are anything but typical.

Securing additional IgG-rich plasma requires expanding the existing network of plasma collection centers. To keep up with 10 percent annual growth in demand translates into recruiting tens of thousands of new donors and performing upwards of three million additional plasma donation procedures each year. As the siting, construction, staffing and securing of regulatory approvals to operate a single new collection center can require up to two years, demand growth must be forecasted and investments made well in advance to assure that extra plasma is collected and ready for manufacturing when it’s needed.

A still longer lead time is required to assure that there will be manufacturing capacity to purify this new plasma into therapeutic proteins. How long? As an example, Baxter announced last August that it broke ground on a new three million-liter fractionation facility near Atlanta. Construction on this $1 billion project is expected to be completed by 2017, with commercial production starting in 2018. America will slog through two more congressional election cycles before the first gram of IG or albumin leaves that facility. No other drug or biologic involves new production capacity development lead times like that.

Four companies — Baxter, CSL Behring, Grifols and Octapharma — manufacture and sell more than half of the albumin and nearly two-thirds of the global supply of polyvalent IG products, according to MRB. And as experienced providers know too well, product shortages are both logistically challenging and costly, as prices overall tend to rise. So are these four manufacturers and a handful of other key suppliers keeping pace with fast-growing global demand for these products?

From all indications, the answer is yes. North American source plasma collections, which account for around 60 percent of all plasma fractionated into therapeutics, have more than doubled between 2005 and 2011 (see Figure 2). And the industry has similarly anticipated the need to expand production, adding more than 15 million liters of plasma fractionation capacity over the last decade. Coupled with this, the industry has found ways to significantly improve IgG yield from each liter, further boosting production capacity.

Peering into the Future

Expanding awareness of the therapeutic benefits of polyvalent IgG and human albumin, together with growing demand in emerging markets such as China and Latin America, will likely extend worldwide demand growth for years to come. In addition, a robust research and development pipeline creates the prospect of important new patient uses. Of particular interest, in light of promising preclinical data and early clinical observations, are trials currently evaluating IVIG and albumin as potential disease-modifying treatments for Alzheimer’s disease and for stroke. Meanwhile, the plasma industry continues to plan and invest for the future to assure that immunoglobulin, albumin and other life-critical plasma products are on the shelf when they’re needed.

* Alternatively, those 30 grams can be purified from “recovered plasma” collected from around 25 screened and tested whole blood donations; each average half-liter unit of blood yields about 250-300 milliliters of plasma.